Overview of CUB's Services

Strengthening the Domestic Market, Expanding into Asia

CUB is committed to delivering comprehensive and diverse financial services to its customers by leveraging its extensive expertise and experience. CUB boasts one of the most extensive networks among Taiwan-funded banks in the ASEAN region. Its network of 67 overseas locations enables it to provide localized services and comprehensive cross-border financial solutions to address customers' needs in financing, investment, and risk management. It helps businesses enhance their international competitiveness by reaching local customer bases and Taiwanese multinational corporations, strengthening cross-border cooperation platforms. CUB also engages in syndicated lending, strategic participation loans, and direct lending; promotes green energy project financing; and develops robust corporate financial solutions. CUB supports its customers in expanding Taiwan's market presence while building a global footprint.

Adhering to the customer-first vision of "One Bank"

-

Driven by digitalization and intelligence, the company accelerates business development across three key areas: new retail, new financial services, and new markets.

-

CUB continues to build a solid foundation in talent development, information technology, risk management, and sustainable operations, striving toward the goal of "Expanding in Asia-Pacific and Reaching New Heights."

-

Key business priorities and growth objectives are formulated, with regular oversight of operational performance by the board of directors.

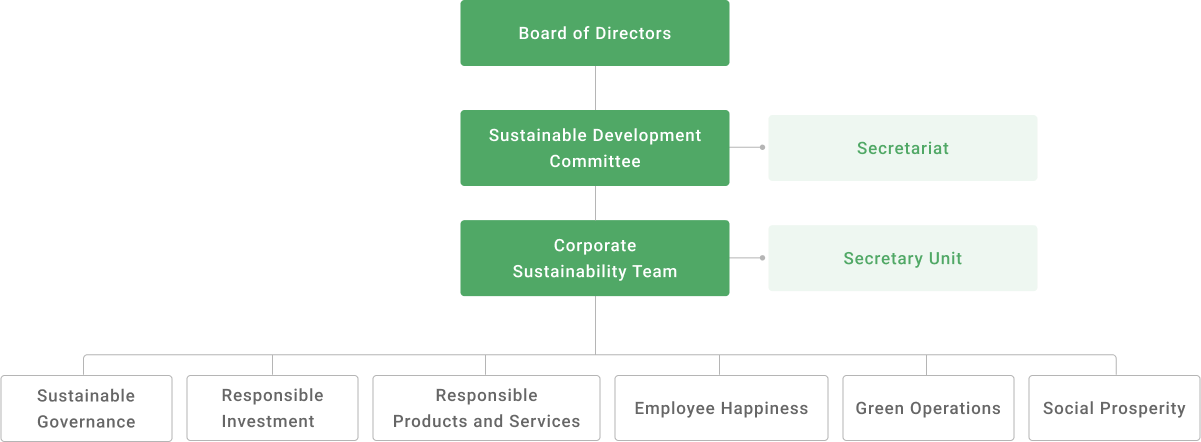

Driving Corporate Sustainability from the Top Down

In 2023, the Bank established the Sustainable Development Committee as the core organization to realize our corporate sustainability vision. We implemented the "Sustainable Development Committee Organizational Regulations" to demonstrate our firm determination to promote sustainable finance and enhance our competitiveness in the field of sustainability development. The current Sustainable Development Committee is a functional committee under the jurisdiction of the Board of Directors, with the Chairman of the Board serving as its chairman. The committee's responsibilities include formulating and revising annual plans and strategic directions for sustainability development, defining sustainability projects and activity plans, convening meetings at least quarterly to track and review the implementation effectiveness of sustainability development plans and projects, and reporting to the Board of Directors. As the highest guiding and supervisory body for the Bank's sustainability development initiatives, the Board of Directors leads the Bank in implementing corporate sustainability principles and policies from top to bottom, actively promoting comprehensive sustainable development.

The Sustainable Development Committee has established the "Corporate Sustainability Team (CS Team), " chaired by the president, to oversee and supervise related matters. The task force serves as the primary organizational unit responsible for promoting corporate sustainability within the Bank. Through the Environmental(E), Social(S) and Governance(G) dimensions, the task force implements sustainable development initiatives. The Corporate Sustainability Task Force convenes quarterly meetings and regularly reports on sustainability work plans and execution results to the Sustainable Development Committee.

The CS Team is further subdivided into six sustainability task groups, each with a specific mission. The following areas are covered by the task force: sustainability governance, responsible investment, responsible products and services, employee happiness, green operations, and social prosperity. Each department participates in different task groups according to its functions. These groups are responsible for implementing the annual plans and strategies adopted by the committee and developing execution plans. In addition to regularly reviewing the implementation of action plans, it also establishes and plans business objectives and budgets to ensure that executing units receive corresponding resources.

Moreover, key objectives are included in the annual KPIs of executives at the level of Vice President and above to ensure alignment of action execution with goals. This approach advances sustainability development work related to the Bank's corporate sustainability vision of "Leading Green Finance, Cocreating a Sustainable Future," thereby realizing and strengthening the Bank's corporate social responsibility efforts.